What if your hospital’s biggest operational challenge could become its most reliable growth lever?

For many healthcare providers in Kenya, the National Health Insurance Fund (NHIF) has long been viewed as an administrative burden — slow reimbursements, tedious paperwork, complex coding. claim denials, complex paperwork, and compliance uncertainty. But when managed properly—and integrated intelligently—a hospital’s NHIF system can evolve from burden to backbone: a predictable revenue stream, better patient satisfaction, and operational clarity.

With over 15 million active members, 8,000+ accredited facilities, and a coverage expanding across both public and private facilities, NHIF is one of the most powerful tools in Kenya’s healthcare landscape. Yet, for many hospitals and clinics, this potential remains unrealized.

What Is NHIF and Why It Matters in Today’s Healthcare Landscape

Understanding NHIF

The National Health Insurance Fund (NHIF) is Kenya’s flagship social health insurance program. Managed by the Ministry of Health, it aims to provide universal access to essential health services by pooling contributions and reimbursing accredited healthcare facilities on behalf of registered members.

NHIF membership is:

- Mandatory for formal sector employees (contributions deducted via payroll)

- Voluntary for informal sector workers, the self-employed, and unemployed individuals

- Government-funded for select groups like pregnant women (Linda Mama), students (EduAfya), and vulnerable populations

Coverage spans a wide range of services:

- Inpatient and outpatient consultations

- Maternity and emergency care

- Dialysis, oncology, and non-communicable disease care

- Lab diagnostics, radiology, and specialist reviews

As of 2024, NHIF supports more than 15 million Kenyans and reimburses services across an expansive network of over 8,000 facilities.

For Patients, NHIF Offers More Than Just Coverage

The practical benefits of NHIF for patients are transformative. It reduces financial pressure at the point of care, encourages early diagnosis and routine check-ups, and allows individuals to access both public and private providers without discrimination based on income level. With rising healthcare costs and growing demand for chronic disease management, NHIF acts as a financial buffer that protects against medical impoverishment.

In many rural and remote areas of Kenya, NHIF is often the only mechanism standing between an illness and access to treatment. Its schemes like Linda Mama have also contributed significantly to reductions in maternal and child mortality by covering antenatal, delivery, and postnatal services at accredited facilities.

For Healthcare Providers, NHIF Can Be a Strategic Growth Channel

While NHIF is essential to patients, it is equally important to providers. For hospitals and clinics, NHIF offers a gateway to increased patient volume, new revenue streams, and institutional credibility. In fact, for many mid-sized and county-level facilities, NHIF accounts for a significant portion of annual income.

But reaping these benefits requires more than accreditation. To truly leverage NHIF, providers must invest in clean data, timely submissions, accurate coding, comprehensive documentation, and defensible audit trails. Without operational discipline, NHIF can lead to high denial rates, financial unpredictability, and compliance risks that weigh down the hospital’s performance.

This is where a robust Hospital Management System (HMS) with a strong compliance focus becomes essential.

The Real-World Challenges of NHIF Integration

Despite NHIF’s national relevance, integrating it into day-to-day hospital operations presents a complex set of challenges. Many facilities still struggle with manual workflows, paper-based claim forms, and disconnected clinical and billing systems that introduce delays and errors.

Common pain points include:

- High claim rejection rates due to invalid coding, outdated tariffs, or incomplete documentation

- Delayed reimbursements that disrupt hospital cash flows

- Fragmented billing and clinical data residing in siloed systems

- Staffing and training gaps that undermine compliance

- Partial or outdated digital adoption that leaves critical workflows exposed

These challenges not only affect financial health but also patient trust and the hospital’s ability to scale sustainably.

A Six-Step Roadmap to NHIF-HMS Integration

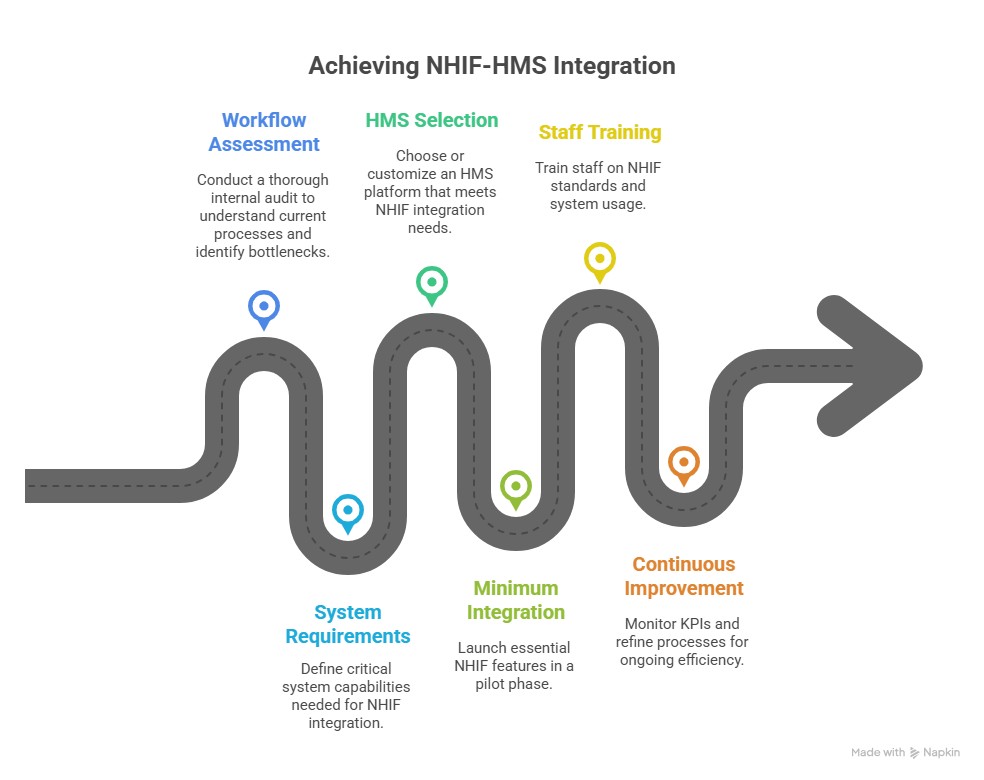

A well-executed NHIF integration requires a methodical, phased approach. Here’s a step-by-step roadmap that can help hospitals digitize their NHIF operations effectively:

1. Conduct a Thorough Workflow Assessment

Begin with a comprehensive internal audit to understand what is currently manual vs. automated. Identify where claim rejections originate, and evaluate how well your current processes reflect the latest NHIF codes, benefit structures, and membership verification methods. Understanding process bottlenecks is the first step toward remediation.

2. Define Your System and Compliance Requirements

Using your assessment, create a checklist of critical system capabilities. These might include real-time NHIF membership checks, automated ICD-10 coding, tariff mapping, dual billing (for NHIF and out-of-pocket services), structured NHIF forms (A & B), role-based permissions, and the ability to adapt to new NHIF policies without vendor delays.

3. Choose or Customize the Right HMS Platform

Look for an HMS that is modular, upgradeable, and able to integrate with external platforms such as NHIF APIs or NHIF-preferred claim formats. Your system should support real-time data capture, automated validations, and secure audit trails.

4. Launch a Minimum Viable Integration

Start small—deploy essential NHIF features such as eligibility validation, automated form generation, and basic claim submission. Run this pilot in parallel to your manual workflows until performance is validated, and then expand functionality across departments.

5. Train Your Staff and Build Institutional Routines

Even the best HMS will fail without proper change management. Train billing, clinical, and administrative teams on NHIF coding standards, documentation protocols, and claims tracking tools. Make NHIF compliance part of your daily operating rhythm.

6. Monitor, Refine, and Improve Continuously

Establish KPIs such as rejection rates, average reimbursement cycles, and claims backlog. Review these metrics monthly and make iterative improvements to your workflows, system configurations, and training practices.

How Medinous HMS Supports NHIF-Aligned Workflows

As hospitals in Kenya look for digital tools that can support compliance, Medinous HMS stands out for its modular architecture, workflow configurability, and payer-aligned design philosophy. Built for emerging healthcare systems across Africa, the Middle East, and Asia, Medinous helps healthcare providers digitize their operations while supporting national insurance processes like NHIF.

Key features that support NHIF-aligned workflows include

Real-Time Eligibility Validation

At patient registration, Medinous allows staff to verify NHIF membership details, scheme type, and insurance identifiers—reducing the risk of downstream claim denials due to ineligible entries.

Auto-Population of NHIF Forms A & B

As clinical records are entered into the system, Medinous automatically populates relevant fields in structured NHIF forms, reducing manual duplication and ensuring compliance with submission formats.

Tariff and ICD-10 Coding Integration

Medinous can be configured to align services with NHIF-approved tariffs and ICD-10 codes, improving coding accuracy and minimizing rejections due to classification mismatches.

Dual Billing Support

Whether a patient is fully insured under NHIF or partially paying out-of-pocket, Medinous enables clean, segmented billing. This ensures clear invoicing and easier audit compliance.

Claims Lifecycle Dashboard

A centralized dashboard tracks all NHIF claims by status—submitted, approved, pending, or rejected—so finance teams can proactively manage workflows and accelerate reimbursements.

Role-Based Access and Digital Audit Information

All actions are time-stamped and user-linked, offering strong internal controls and full traceability during NHIF or Ministry audits.

Because Medinous is modular, facilities can implement NHIF-relevant workflows in phases—starting with core features and expanding as capacity grows.

Anticipating Challenges and Building Resilience

While integration brings benefits, hospitals must also be prepared for real-world hurdles. NHIF benefit packages, tariffs, and documentation requirements change frequently. Staff may resist digital adoption due to familiarity with manual systems. Rural facilities may face internet and power reliability issues. Legacy data can create inconsistencies during migration.

These are not reasons to delay integration—but reminders to approach it with realistic timelines, strong leadership, and cross-functional involvement.

What a Fully Integrated NHIF System Delivers

Once NHIF workflows are integrated into your HMS, your hospital gains:

- Lower rejection rates from clean, validated data

- Faster reimbursement cycles and improved cash flow predictability

- Reduced administrative overhead and better resource utilization

- Audit readiness through role-based logging and digital trails

- Higher patient satisfaction from seamless insurance experiences

Digitization is the First Step to NHIF Advantage

In Kenya’s journey toward universal health coverage, hospitals that invest in NHIF-aligned systems will be better equipped to meet rising patient expectations, operational pressures, and financial demands.

Medinous HMS is purpose-built to support this transformation. Whether you’re a district-level facility taking the first steps or a tertiary center preparing for high-volume claim handling, Medinous offers the digital foundation to help you streamline NHIF operations—securely, smartly, and sustainably.

Ready to explore how your hospital can build a smarter NHIF workflow?

Request a demo with our experts today and take the next step toward financial resilience and patient-centered care.